Jump To Section

- 1 The Current State: Why Traditional Data Approaches Fall Short

- 2 Building the Foundation: Three Pillars of Modern Data Management

- 3 The Strategic Roadmap: Four Phases to Data Excellence

- 4 Success in Action: Real-World Impact

- 5 Future-Ready: Emerging Trends Shaping Data Strategy

- 6 Final Takeaways: Your Path Forward

- 7 FAQs

In financial services, data has long been touted as the new oil. Yet for many institutions, that oil remains untapped, locked away in silos, fragmented across legacy systems, and hindered by poor governance.

As regulatory demands tighten and customer expectations soar, data readiness is no longer optional; it plays a critical role in innovation, compliance, and growth. A strong data strategy ensures insights are generated cost-effectively, enabling institutions to maximize the value of their data assets.

Effective data cleansing and transformation processes are vital for maintaining high data quality, ensuring that insights derived from data are both reliable and actionable.

But the question isn’t whether to modernize your data strategy. It’s how to do so in a way that drives measurable business outcomes.

This article explores the challenges holding financial services back, the emerging trends shaping data strategies, and the priorities that will set you apart in the industry.

You’ll learn how a sustainable data strategy embedded across financial services business practices and reporting requirements ensures long-term success by aligning with business outcomes.

The Current State: Why Traditional Data Approaches Fall Short

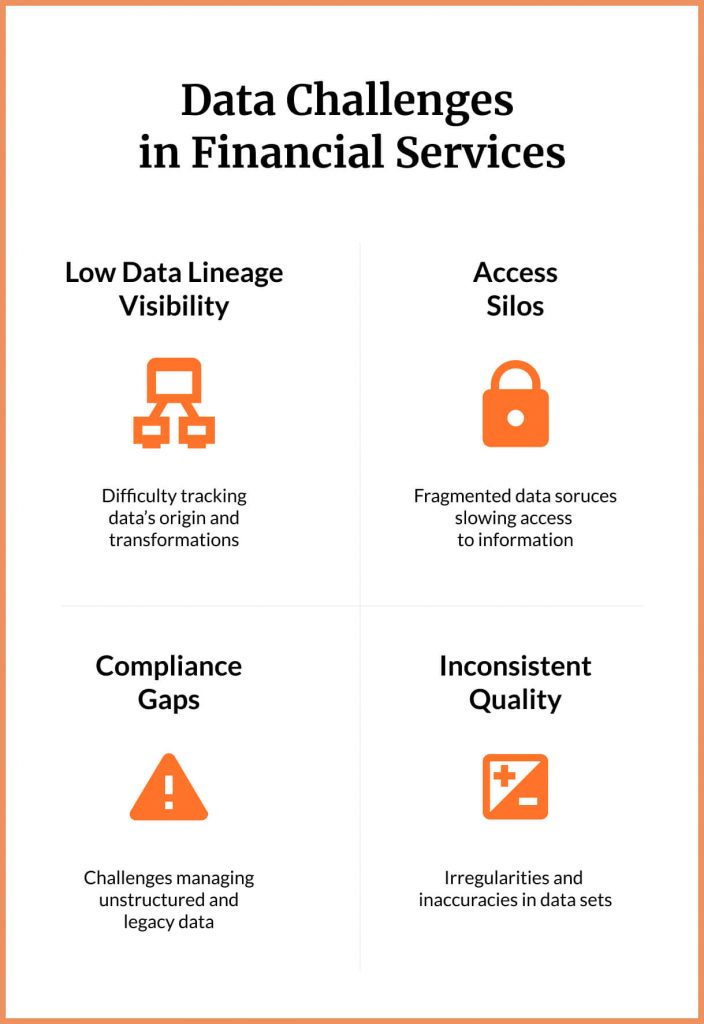

Despite massive investments in technology, 66% of banks still report persistent data quality issues that directly impact their bottom line. Financial institutions, including banks, credit unions, insurers and asset managers, operate in one of the most data-intensive industries, yet they face persistent data challenges:

Low Data Lineage Visibility and Inconsistent Quality

Without clear lineage, it’s difficult to track where data comes from, how it has been transformed, or whether it can be trusted. Tracking data elements is essential to ensure the right data is used for analytics and compliance. This lack of transparency undermines confidence in analytics and decision-making, making it harder for a financial institution to have the right data for better decisions.

Access Silos that Slow Decision-Making

Data often resides in isolated systems across departments, with fragmented data sources making it hard to integrate big data across the organization. This fragmentation creates bottlenecks for everything from credit risk assessments to fraud detection.

Compliance Gaps in Unstructured and Legacy Data

Regulations like GDPR, CCPA, and North American equivalents require financial firms to manage not just structured data in databases but also unstructured data: emails, documents, voice recordings. Legacy systems often lack the tools for robust oversight, making it difficult to meet reporting requirements and exposing firms to compliance risks.

Inconsistent Quality

Disparate data sources, outdated systems, and manual entry processes often result in irregularities, duplicate records, and missing values. This undermines confidence in analytics and impairs operational efficiency.

Building the Foundation: Three Pillars of Modern Data Management

As financial institutions handle vast volumes of enterprise data, establishing robust data management frameworks is essential for data life cycle management, right from sourcing, processing and consumption stages. It is imperative to maintain trust, meet regulatory requirements, and support business growth. Leading financial institutions are moving beyond reactive data fixes to proactive, strategic data management built on three core pillars:

Pillar 1: Operationalizing Data Quality at Scale

According to Gartner, poor data quality costs organizations an average of $15 million per year, and 66% of banks report persistent quality issues that directly impact analytics and regulatory reporting. Over 94% of banking executives now rank data accuracy and reliability as top priorities.

To address this, leading financial institutions are embedding data quality management directly into operations through a combination of tactical controls and strategic governance:

Validation and profiling at entry points

Robust validation rules are implemented at ingestion to catch incomplete or erroneous data early. Regular profiling identifies anomalies, missing values, and inconsistencies, reducing risk and enabling clean, reliable analytics.

Data observability for continuous monitoring

Traditional quality checks are being replaced by real-time observability platforms. These tools proactively detect anomalies, schema drift, and duplication across pipelines—ensuring teams can respond to issues before they cascade into compliance reports or dashboards.

Domain ownership and stewardship

Financial services firms increasingly assign ownership of specific data domains to business-aligned stewards. These roles are responsible for maintaining data quality standards and are often backed by performance metrics tied to data quality KPIs.

Metadata management and lineage tracking

Detailed lineage and metadata catalogs document the source, transformation, and downstream usage of data. This improves root-cause diagnostics and supports transparency in regulatory audits, while avoiding redundant or inconsistent use of data.

Data quality intelligence and scorecards

Institutions are increasingly adopting centralized dashboards that track quality dimensions like accuracy, timeliness, and completeness across business domains. This helps prioritize remediation and align quality with business goals.

By making data quality a continuous, monitored, and governed discipline rather than a one-off cleanup, financial institutions unlock faster reporting cycles, dependable analytics, and greater trust in AI outputs. In a market where decisions are only as good as the data that informs them, operationalizing quality at scale is now a strategic imperative.

Pillar 2: Fortifying Security Against Evolving Threats

Data security is equally critical. With cyber threats becoming increasingly sophisticated, institutions must go beyond basic protection.

Financial institutions face increasingly complex threats, from ransomware and phishing to insider risks and cloud vulnerabilities. In 2024, nearly two-thirds of financial organizations were hit by ransomware, with phishing accounting for 49% of breaches. Deepfake-enabled social engineering and third-party supply chain attacks are rapidly rising.

To counter these threats, banks and insurers are doubling down on defence-in-depth strategies:

Encrypt everything

Sensitive data is encrypted at rest and in transit, supported by strong key management. With quantum threats looming, 72% of FSI leaders are preparing by exploring quantum-resistant encryption.

Identity and Access Management (IAM)

Financial institutions implement strict IAM policies, including MFA, fine-grained access, and privileged account controls—aligned with Zero Trust principles, now being adopted by 70% of firms.

Data Loss Prevention (DLP)

Real-time DLP systems prevent unauthorized data transfers, complemented by user behavior analytics to detect insider threats.

Threat monitoring and SOCs

24/7 security operations centers (SOCs) monitor for anomalies using AI and threat intel. Automated responses and incident containment are standard practices.

Cloud-native security

Cloud controls include encryption, SSO, identity federation, and security scanning integrated into DevSecOps pipelines.

These practices are reinforced by a dynamic regulatory landscape. Laws like GDPR, CCPA, GLBA, and Canada’s OSFI Guideline B-13 mandate encryption, IAM, breach reporting, and third-party oversight.

New SEC rules require rapid cyber incident disclosure, pushing security into the boardroom. Regulatory compliance is now a key budget driver for cybersecurity programs.

By embedding data security into infrastructure, access management, cloud platforms, and compliance reporting, financial institutions strengthen resilience and reinforce trust with stakeholders.

Pillar 3: Strategic Alignment for Business Impact

Modern data governance is not just a technical safeguard but a strategic enabler. In financial services, where data drives everything from credit risk models to personalized banking experiences, aligning data initiatives with enterprise priorities is essential for ROI, agility, and compliance.

Strategic alignment begins with executive sponsorship and governance councils. Many leading firms establish data governance boards or councils composed of senior leaders from both business and technology functions. These bodies define enterprise data priorities, approve policies, and ensure alignment between governance decisions and corporate KPIs.

Additionally, organizations are increasingly adopting federated governance models, where domain-level ownership of data is assigned to business-aligned stewards. For example, a head of retail banking may be responsible for the quality and usage of customer account data. This business-led accountability ensures that data governance supports day-to-day operations and strategic outcomes alike.

Governance frameworks also support strategic alignment by:

- Linking data initiatives to measurable business goals (e.g., faster loan processing, improved regulatory reporting accuracy, personalized product offers)

- Reducing duplication and redundant efforts, especially across siloed departments, by standardizing data definitions and ownership

- Improving decision quality by ensuring data used for forecasting, compliance, and AI is accurate and trusted

- Driving enterprise-wide adoption of policies, such as retention schedules, classification rules, and access controls

Organizations that treat data governance as a business strategy rather than a compliance checkbox consistently report improved data value realization and organizational trust in data.

The Strategic Roadmap: Four Phases to Data Excellence

Transformation requires a systematic approach. Here’s the proven four-phase roadmap that leading institutions are using to unlock their data’s potential.

Phase 1: Design Data as a Product

Treat data as a first-class product with dedicated owners, clear access policies, and lifecycle management to ensure it is accountable, accessible, and secure.

Phase 2: Build Infrastructure for Compliance and Agility

Cloud-native architectures enable scalability, resilience, and continuous compliance monitoring, essential for responding to ever-evolving regulations. Effective financial management and financial operations, including FinOps practices, are critical for optimizing cloud spending and ensuring compliance within these modern infrastructures.

For a detailed, hands-on guide on modernizing legacy infrastructure, be sure to read this article: The Core Banking Modernization Dilemma: Incremental vs. Full System Upgrade

Phase 3: Enable Front-Line Teams Through Data Democratization

Equip advisors, underwriters, and operations teams with low-code platforms and AI co-pilots, making insights actionable at every level of the organization. Organizations should democratize data to eliminate bottlenecks and enable faster decision-making throughout the company, directly supporting marketing strategy and revenue generation by empowering teams to act on real-time insights.

Phase 4: Integrate Regulatory Frameworks and Build Resiliency

Embed compliance rules directly into data and AI platforms to ensure they are proactively enforced. Continuous monitoring strengthens operational resilience and supports audit readiness.

Developing comprehensive data strategies requires breaking large data projects into manageable stages, ensuring progress is both achievable and measurable. Success stories from leading institutions demonstrate the tangible impact of these strategic priorities on business outcomes.

Success in Action: Real-World Impact

Theory becomes reality when properly executed. A major North American insurer’s transformation demonstrates the tangible benefits of strategic data management. The insurer faced mounting challenges with siloed data and inconsistent reporting, which hampered its ability to respond to regulatory audits.

By implementing a unified governance framework and migrating to a cloud-native data platform that integrated third-party data to enhance business insights, the company achieved:

- 40% reduction in compliance reporting time

- 30% improvement in data quality scores across business units

- Faster rollout of AI-powered underwriting models

The transformation didn’t just streamline operations but aligned the data strategy with broader business goals, enabling more effective strategic decisions and allowing the insurer to innovate confidently while staying compliant.

Future-Ready: Emerging Trends Shaping Data Strategy

As AI reshapes financial services, institutions must prepare for trends that will define the next decade of data-driven competitive advantage. Below are the most impactful trends shaping data modernization and intelligence enablement across the industry, each with specific business implications for compliance, operational agility, and customer growth.

1. Building a Data-Driven Culture

Institutions are shifting from experience-based decision-making to evidence-based models grounded in data transparency. A true data-driven culture isn’t just about dashboards, but also extends to widespread data literacy, executive buy-in, and daily usage of insights to guide decisions at all levels.

Firms with strong data cultures are 2.5 times more likely to outperform peers on key financial metrics, according to MIT Sloan. These organizations close the loop between insights and action, accelerating marketing precision, fraud mitigation, and customer service personalization.

2. Enterprise Governance Models with Clear Ownership

Leading organizations are moving toward federated data governance, where business units take ownership of specific data domains. Data stewards are empowered with tools, KPIs, and authority to manage data quality and compliance locally, while aligning to central policies.

This structure reduces bottlenecks, ensures faster response to business needs, and improves trust in enterprise data assets. It’s also essential to scale governance across cloud, hybrid, and third-party ecosystems without compromising consistency.

3. Real-Time Data Platforms and Self-Serve Analytics

Legacy analytics cycles are giving way to real-time data infrastructure, where data flows continuously and is instantly available for reporting or AI applications. These platforms, often cloud-native, support advanced use cases like anomaly detection, on-demand risk scoring, or next-best-offer recommendations.

Teams can now access insights without waiting on IT. Institutions using self-serve analytics report a 28% increase in decision velocity and faster regulatory response times, according to a McKinsey report.

4. Hybrid Data Architectures for AI Readiness

AI needs more than data: it needs connected, clean, and context-rich data. Hybrid architectures allow structured (e.g., transactions) and unstructured (e.g., call logs, documents) data to be accessed securely through a unified architecture.

Institutions with hybrid data fabrics are unlocking faster time-to-model for credit scoring and claim automation while also ensuring lineage, traceability, and scalability for AI experimentation.

5. Generative and Agentic AI Platforms

The financial sector is exploring generative AI for use cases like marketing content, customer support, and policy summarization. Meanwhile, agentic AI platforms are being tested to automate workflows, initiating actions based on real-time insights, not just predictions.

These technologies reduce manual effort, cut cost-to-serve, and elevate customer experience. Early adopters of generative AI in banking are seeing productivity lifts of 20 to 30% in support and compliance functions, states a BCG report.

6. Trustworthy, Explainable AI with Ethical Guardrails

With AI now influencing loan approvals, fraud flags, and compliance alerts, transparency is vital. Explainability tools help non-technical users understand how AI reached a decision, while ethical guardrails ensure outputs are bias-free and regulator-ready.

Without explainability, adoption stalls. With it, institutions unlock AI trust, smoother audits, and ethical risk mitigation. In fact, nearly 70% of FSI executives cite explainability as a top investment priority for AI scaling (Gartner).

7. Data Readiness for Compliance and AI

Every trend above depends on data readiness: the ability to deliver clean, complete, and compliant data to the right place at the right time. This includes having metadata, lineage, access controls, and validation baked into data platforms.

Without readiness, AI falters, reports fail audits, and customer trust erodes. Firms with high data readiness scores report 40% fewer compliance issues and smoother AI model deployment pipelines.

Organizations that modernize their infrastructure, embrace AI responsibly, and foster a culture of data-driven decision-making will not only meet today’s challenges but also create a foundation for sustainable growth and innovation in an increasingly competitive marketplace.

Final Takeaways: Your Path Forward

A strong data foundation is not a “nice to have” for an industry as heavily reliant on data (and its security); it is critical for staying at the top of an AI-driven, highly regulated environment. This means:

- Breaking down silos with unified governance and hybrid data architectures.

- Empowering teams with real-time, self-serve analytics and AI co-pilots.

- Embedding compliance and ethical safeguards directly into data platforms.

- Investing in scalable, cloud-first infrastructure to future-proof operations.

In a market moving at the speed of AI, it’s not the biggest banks that will win but the ones who know their data best, move fastest, and trust it enough to bet the business on it. Those who build a data strategy rooted in purpose, not just platforms, will be the ones to shape where the industry goes next: faster to innovate, stronger in compliance, and smarter at scale.

FAQs

What is a data strategy in financial services?

A data strategy is a roadmap for how financial institutions collect, manage, and leverage data to drive business outcomes, ensure compliance, and support innovation.

Why is data governance critical for banks and insurers?

Strong data governance ensures data quality, consistency, and compliance with regulations like GDPR and CCPA, reducing risk and enabling better decision-making. Top-level executives need to sponsor and drive key decisions around data and data storage to embed it within the organizational culture effectively.

How can financial institutions prepare for AI adoption?

By building hybrid data architectures that unify structured and unstructured data, and embedding ethical safeguards to ensure explainability and trust.