Jump To Section

- 1 Why Embedded Intelligence Must be Built into the Financial Product

- 2 Where UX Fails: Why Good Signals Don’t Always Convert

- 3 Financial Ecosystems and Services: The New Context for Intelligent Products

- 4 Closing the Loop: From User Signal to Action to Revenue

- 5 Three Product Plays to Enable Monetization and Unlock New Revenue Streams

- 6 Case Study: Making Lending Smarter and More Profitable with Embedded Finance

- 7 Final Takeaways: Growth Through Product Design

- 8 Frequently Asked Questions (FAQs)

What if your financial product could sell itself? Instead of relying on marketing emails or banner ads, what if your app intuitively guided customers toward smarter decisions, all while unlocking new revenue streams for your business?

In an era where customer expectations evolve faster than legacy systems, financial services leaders face a critical choice: continue offering static, one-size-fits-all tools or embed intelligence directly into their products to drive engagement and growth.

This article is your blueprint for transforming digital financial products into intelligent growth engines. You’ll discover how leading institutions are using real-time data, adaptive interfaces, and behavioral models to:

- Predict customer needs and act in the moment.

- Increase product adoption and customer lifetime value.

- Turn every interaction into a monetization opportunity.

If your goal is to innovate and create products that drive both customer loyalty and profitability, the insights here will help you get there faster.

Why Embedded Intelligence Must be Built into the Financial Product

Today’s smart financial tools go far beyond digitizing traditional banking services. They don’t just provide users with static information or replace paperwork with electronic forms.

Instead, they leverage real-time data and behavioral signals to create dynamic, context-aware experiences that influence financial decisions in the moment. These tools help users achieve better outcomes while enabling the business to unlock new revenue streams. Embedding intelligence in this way provides a competitive advantage, allowing businesses to differentiate themselves with more personalized and efficient financial offerings.

The product itself becomes a hybrid of service and sales. It doesn’t just inform; it interacts. Embedded intelligence is more than just a tool; it is a driver of innovation and adaptability, challenging traditional models and encouraging smarter, more inclusive financial services.

By using embedded intelligence, it prompts users toward beneficial actions like saving more, spending less, investing surplus funds, or switching to lower-interest options. These moments are not just service enhancements; they are monetization opportunities seamlessly woven into the experience.

For instance, consider two types of budgeting apps. One simply reports where the user spent money, perhaps with a pie chart. The other analyzes spending behavior, detects unused funds, and suggests actions like opening a high-interest savings account or paying off a high-interest loan. The second app acts like an assistant, making the user’s financial life easier and more optimized.

To build such capabilities, product teams must adopt a structured approach:

- It begins with recognizing user behavior (Insight),

- Leads to real-time UI interventions (Activation), and

- Results in revenue-impacting decisions (Monetization).

This approach requires that intelligence be deeply integrated into the product’s core workflows and functionalities, rather than simply layered on top.

Data only generates value when it actively shapes user behavior.

In the following sections, you will learn three key strategies to embed intelligence directly into the user experience and convert signals into growth:

- Build real-time insight APIs that feed actionable intelligence into the product

- Design interfaces that adapt to user decisions and personalize the journey

- Smartly track key monetization metrics such as Product-Qualified Leads (PQLs) and Customer Lifetime Value (CLV)

These building blocks create the foundation of intelligent, product-led growth.

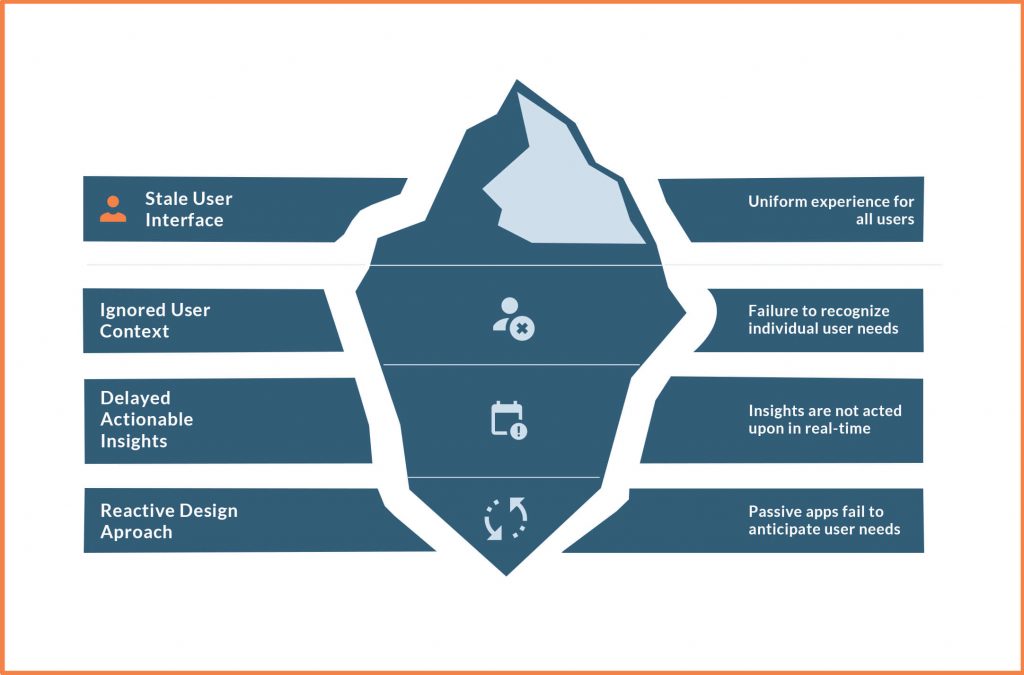

Where UX Fails: Why Good Signals Don’t Always Convert

Even though modern fintech apps collect an abundance of user data, many of them fall short in how they use it. This shortfall is due to legacy user experience patterns, slow data-to-action cycles, and lack of proactive design.

When personalization is lacking, users are more likely to abandon the app, which negatively impacts the overall customer experience and weakens customer relationships.

1. Static Interfaces Miss Important Context

Most apps treat users as generic profiles. They offer the same homepage or dashboard regardless of context. A user who just received a salary and one whose account is overdrawn will see the same set of buttons, cards, and graphs.

This uniformity wastes critical opportunities. For example, someone with a recent income deposit could be nudged toward investments, while someone with low balance might need overdraft protection.

Yet both users are given the same stale interface. Failing to integrate intelligence into business workflows means these apps miss out on delivering personalized and operationally efficient solutions tailored to each user’s situation.

The cost of ignoring context is high. Personalization is no longer a luxury; it is a requirement for meaningful engagement and conversion. Users expect the digital experience to mirror their real-world needs.

Learn how you can design better interfaces that go beyond mere usability in this article here: Beyond the Interface: Designing Better Digital Banking Experiences

2. Delayed Insights Lead to Missed Opportunities

Even when fintechs generate actionable insights, many delay acting on them. Behavioral triggers often go unnoticed until they are analyzed in batch or exported to a marketing system.

For instance, a user who receives an email three days after experiencing a declined transaction will find the offer irrelevant. The moment has passed. The message gets ignored or flagged as spam.

Remember: Insight delayed is value denied.

In contrast, real-time action matters. A product must be able to respond to behavioral cues instantly, like alerting users when they exceed their budget, offering a loan when their balance drops, or suggesting an investment when there’s cash idle.

Real-time insights can also streamline lending processes, improving efficiency and accuracy from loan approval through origination, risk assessment, and repayment management.

3. Reactive Design Means Poor Personalization

Many apps are passive. They wait for users to explore features or click into pages before showing new offers or content.

This “if the user finds it, they’ll use it” mindset is flawed. Most users don’t have the time or interest to explore deeply. They expect the app to surface relevant options and walk them toward smarter decisions.

AI can bridge this gap by analyzing past activity and predicting future needs. For example, if a user frequently transfers money abroad, the app might suggest a low-fee international transfer option, and recommend the most suitable payment method—such as a saved credit card or bank account—to make the process even smoother.

Failure to personalize means missed opportunities to engage, upsell, and retain users. The longer the app remains static or generic, the more likely users are to abandon it.

Financial Ecosystems and Services: The New Context for Intelligent Products

The financial landscape is undergoing a profound transformation as embedded finance becomes a cornerstone of modern business models.

No longer confined to traditional banks or standalone apps, financial services are now being woven directly into the fabric of non-financial platforms—think e-commerce sites, ride-sharing apps, and even retail loyalty programs.

This shift is redefining how financial institutions connect with customers and unlock new revenue streams.

By embedding financial services such as payments, lending, and insurance into everyday digital experiences, companies are not only meeting consumer demand for convenience and personalization but also driving deeper customer engagement and loyalty.

For non-financial companies, this means the ability to offer integrated financial services—like embedded lending or flexible payment options—without the need to build a bank from scratch. The result is a win-win: customers enjoy seamless access to financial products right where they need them, and businesses tap into new revenue streams that were previously out of reach.

The embedded finance market is experiencing rapid growth, fueled by the rise of fintech companies and the increasing expectation for frictionless, personalized financial experiences.

Traditional financial institutions are responding by forming strategic partnerships with fintech innovators, leveraging their technology and expertise to embed banking products into non-financial platforms. These collaborations enable traditional banks to remain competitive, expand their reach, and deliver tailored financial solutions to new customer segments.

Artificial intelligence is playing a crucial role in this embedded finance revolution. AI-driven innovation allows financial institutions to offer personalized financial advice, improve risk assessment, and prevent fraud—all in real time. AI models analyze vast amounts of financial data to deliver smarter, more relevant financial solutions, enhancing both customer satisfaction and operational efficiency.

This not only streamlines risk management and cash flow processes but also enables financial institutions to serve previously underserved or excluded populations, advancing financial inclusion and access. Discover the full potential and impact of AI on the future of the financial services industry here.

Secure application programming interfaces (APIs) are the backbone of this transformation, enabling seamless integration of banking services and financial data into non-financial platforms.

With robust APIs, companies can embed banking as a service, offer small business loans, or launch branded credit cards—all while maintaining regulatory compliance and data security.

As the embedded finance revolution gains momentum, the future of embedded finance looks increasingly promising. The financial sector is poised for continued growth, with embedded finance opening up new opportunities for both financial institutions and non-financial businesses.

By leveraging AI, strategic partnerships, and flexible embedded finance solutions, organizations can create new revenue streams, improve customer loyalty, and deliver more personalized, efficient financial services.

In this new era, intelligence is not just a feature—it’s a fundamental requirement.

Financial institutions that embrace embedded finance and AI-driven innovation will be best positioned to thrive, driving financial transformation and shaping the future of integrated financial ecosystems.

Accelerate product innovation to stay ahead of fintech disruptors using these strategies here.

Closing the Loop: From User Signal to Action to Revenue

To achieve successful embedded intelligence in financial products, it is essential to consider key factors such as digital payment solutions, e-commerce growth, innovative payment services, supportive infrastructure, favorable regulations, collaborative fintech initiatives, and financial literacy programs.

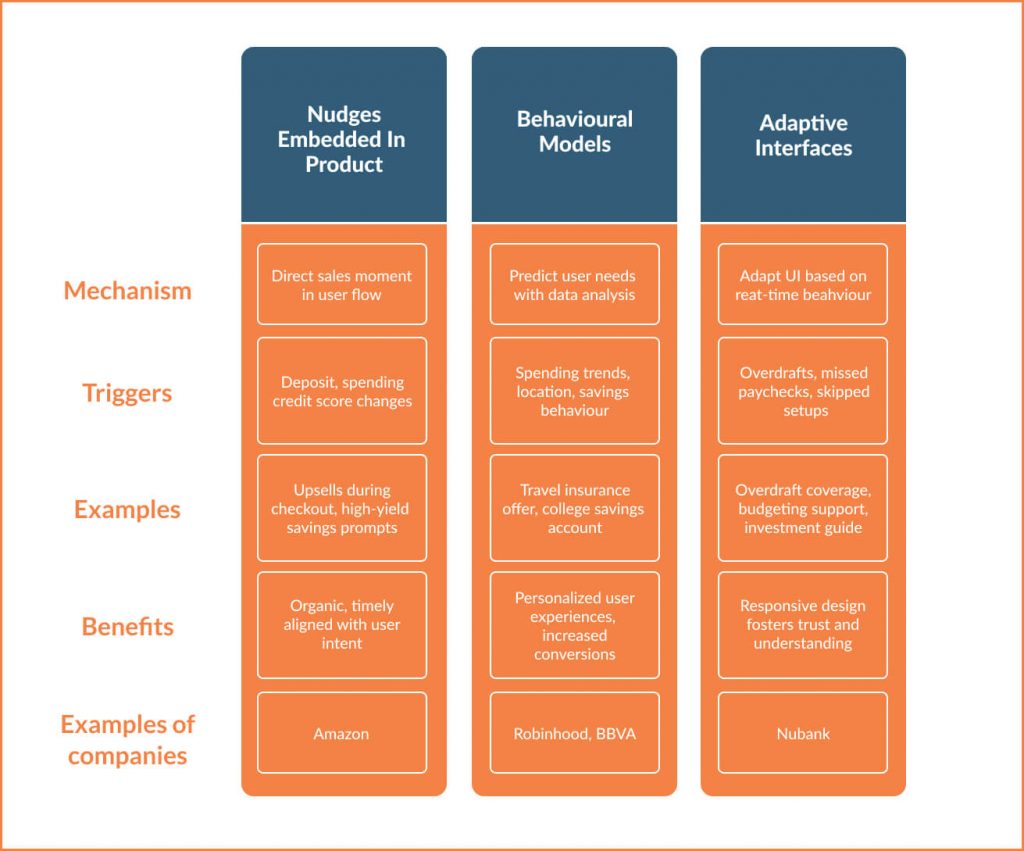

A. Nudges Embedded in the Product

When your product is the primary channel of communication, it becomes the most powerful driver of revenue. Instead of relying on emails, banners, or marketing calls, place the sales moment directly into the user’s flow.

Consider how e-commerce platforms like Amazon make upsells natural by recommending items during checkout. Fintechs can adopt this model: “Looks like you have extra funds this month, consider earning 2.5% in a high-yield savings account.”

These nudges should occur within the app’s most visible areas: home screens, transaction timelines, or push notifications. They must feel organic, timely, and aligned with the user’s intent.

For instance:

- A deposit event triggers an investment opportunity.

- A high-spend pattern suggests a budget cap or cashback card.

- An improved credit score leads to a better loan offer.

- Embedded payments can be used to streamline the checkout process, allowing users to complete transactions or pay bills directly within the app, reducing friction and increasing convenience.

The more context-aware the prompt, the more likely it is to convert. This approach turns the app into both assistant and advisor.

B. Using Behavioral Models and Artificial Intelligence to Boost Lifetime Value

Behavioral models analyze rich data to predict what a user is likely to want next. These models process everything from spending trends to location, time of day, savings behavior, and preferred features.

The output is not just a static score, but an evolving prediction. It identifies high-propensity actions that signal readiness for offers. AI-driven credit scoring can also assess eligibility and personalize lending offers by leveraging alternative data sources, improving accuracy and fairness in lending decisions, and speeding up credit evaluations.

For example:

- A user who deposits a large amount and searches travel deals may trigger a travel insurance or credit card offer.

- A new parent might receive prompts for a college savings account.

These models adapt as users accept or ignore offers, creating feedback loops that refine future predictions. Robinhood and BBVA have leveraged such models to personalize user experiences, leading to 25–28% increases in conversions.

Behavioral intelligence transforms customer interaction from generic nudging to highly relevant coaching. This, in turn, drives higher product adoption and retention, boosting customer lifetime value.

C. Interfaces That Adapt to User Behavior

Smart products adapt their UI paths based on real-time behavior. Rather than showing the same journey to all users, they offer dynamic experiences that evolve with the user’s needs.

For example:

- If a user hits an overdraft, the app should immediately show options to cover the shortfall.

- If a user misses multiple paychecks, it might recommend short-term credit or budgeting support.

- If a user skips investment setup, the next login should feature a personalized guide on the home screen.

Nubank does this well. Its app reorders home screen elements to match each user’s recent actions. Cards might appear suggesting bill payments, insurance offers, or reminders for financial milestones. A well-designed banking app can dynamically adapt its interface to user behavior, further enhancing engagement.

This kind of responsive design fosters a sense of understanding and trust. It tells the user, “This app knows me.”

Building this requires modular components, real-time state engines, and design systems that prioritize condition-based rendering over static pages.

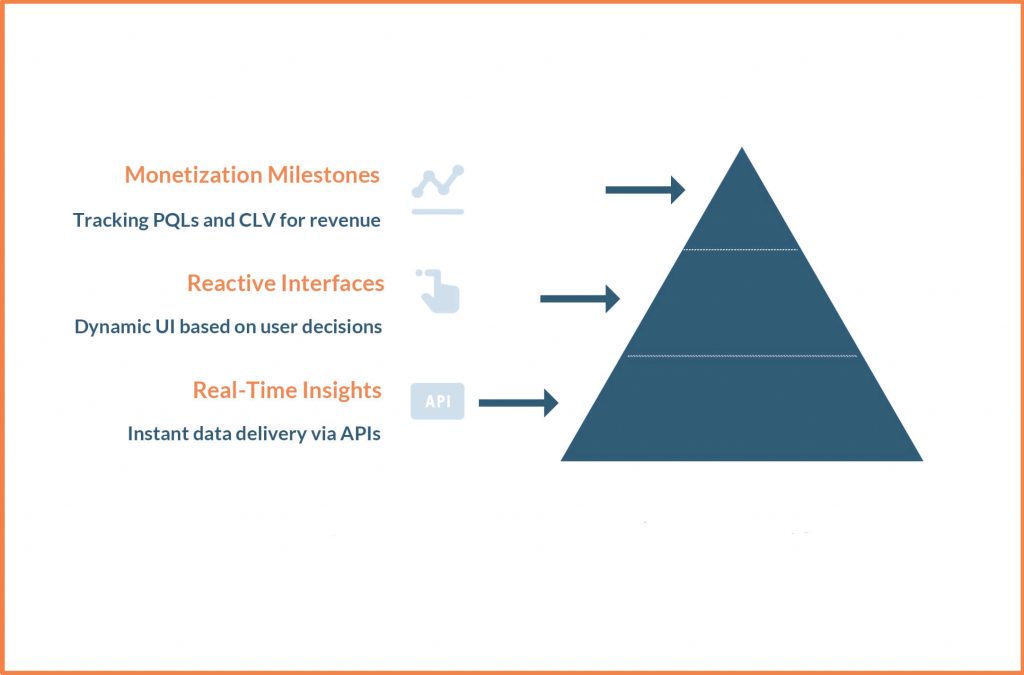

Three Product Plays to Enable Monetization and Unlock New Revenue Streams

To truly capitalize on embedded intelligence in financial products, it’s essential to move beyond data collection and static interfaces. The key lies in transforming raw insights into real-time actions that guide users toward smarter financial decisions while driving revenue growth.

This section outlines three practical product strategies that empower fintech companies to embed intelligence seamlessly into their user experience, turning customer interactions into valuable monetization opportunities.

Play 1: Create Real-Time Insight APIs

Raw insights are only valuable when delivered instantly. Most fintechs collect data, but insights remain siloed in dashboards or BI tools. That’s not fast enough.

Instead, expose insights through APIs. Make predictions from ML models available to the app’s frontend in real time. Create an internal “insight store” where scores and classifications can be consumed by product features.

For example:

- A “churn risk” score decides whether to show a retention incentive.

- A “savings strength” score influences whether to recommend investments.

Product and data teams can collaborate in “insight sprints” to embed one high-value insight into an interface.

This unlocks use cases like:

- “You’re on track to exceed your budget.”

- “Your rewards earned this month could be redeemed for X.”

Real-time insight is the fuel for intelligent UX. By enabling instant access to actionable data, real-time insight APIs help build a more connected and intelligent financial ecosystem, where services and features work seamlessly together to enhance user experience and drive innovation.

Play 2: Design Interfaces That React to Decisions

Static interfaces don’t cut it anymore. Design flexible UI components that appear or disappear based on user state and decisions.

Use modular dashboard elements, often referred to as cards or tiles, which reflect a user’s financial situation:

- A user with high credit usage sees a card for debt consolidation.

- A frequent card user sees a reward summary.

- Someone who just paid a bill sees a credit score update.

Adaptive interfaces can also help attract and onboard new customers by presenting relevant, timely offers that match their needs and encourage engagement.

These elements should be rule-driven, using decision engines configured by non-engineers. Marketing or product teams can define when to surface each component.

This approach allows fast iteration and ensures the interface stays relevant as user needs evolve. It’s more than layout – it’s behavior-driven rendering.

Play 3: Monitor Monetization Milestones (PQLs and CLV)

To measure success, track how product engagement drives revenue.

Use Product-Qualified Leads (PQLs) to identify users who are ready for upgrades based on behavior. Examples include:

- Linking an external account

- Creating multiple savings goals

- Daily use of a specific feature

Each PQL represents a conversion-ready user.

Also monitor Customer Lifetime Value (CLV). This metric reflects the total worth of a user, factoring in product adoption, retention, and upgrades.

Improvements in personalization and UX should result in higher CLV. Personalized offers increase conversion rates, deepen engagement, and reduce churn.

Example: Banking apps using personalization often report a 10-15% boost in revenue and up to 28% conversion improvement.

Tie every new feature or experiment to movement in PQL and CLV metrics. That keeps teams focused on real business outcomes. Tracking these metrics also helps organizations see how their embedded intelligence strategies gain momentum and drive growth.

Case Study: Making Lending Smarter and More Profitable with Embedded Finance

The Problem

A regional digital bank was experiencing user drop-offs during its personal loan application process. Outdated lending processes contributed to these drop-offs and inefficiencies, as customers faced friction in the form of lengthy forms, delayed approvals, and limited real-time support. The bank wanted to modernize this journey by embedding intelligence and monetization directly into the user experience.

The Transformation for the Financial Institution

Partnering with the bank’s product and engineering teams to design an end-to-end lending flow powered by real-time behavioral intelligence, a new approach was adopted that allowed the product to act contextually, driving both faster fulfillment and greater customer engagement. Advanced credit scoring models were used to assess eligibility in real time, enabling more accurate and fair lending decisions.

The Solution

- Fine-tuned ML models that continuously analyzed user data including income deposits, recurring bills, spending trends, and account balances.

- These models generated a dynamic credit eligibility score that updated in real time.

- Once the system detected financial stress or a potential borrowing need, the app delivered a pre-approved loan prompt embedded within the user’s regular transaction feed. This approach made it easier for users to access credit directly within the app, supporting greater financial inclusion and participation in the digital economy.

User Experience

- A contextual card appeared: “Need $500 to manage your upcoming bill? You’re pre-approved – tap to accept.”

- If accepted, the funds were transferred instantly. Users could access financing seamlessly without leaving the app.

- KYC, identity verification, and risk assessments ran silently in the background using existing data profiles.

The Results

- Loan approval time was reduced by 60%, improving speed to value.

- Users who accepted the smart loan offer used 30% more banking products within the next 90 days.

- Overall CLV rose 18% for this segment, as they engaged more deeply with the bank’s ecosystem.

- Net Promoter Score (NPS) improved due to the seamless and timely nature of the experience. The enhanced customer experience, driven by embedded financial services and AI integrations, contributed to higher satisfaction and loyalty.

- Churn decreased, particularly among previously underserved users.

Execution

- A condition-triggered loan module was designed using modular UI components.

- Insight APIs were integrated into the frontend, pulling model scores for each user session.

- Regulatory compliance was prioritized through transparent language, opt-out options, and explainable AI decisioning.

This approach to intelligent product design was to embed real-time intelligence into everyday user journeys, turnkey moments into monetization triggers, and increase product stickiness without relying on traditional marketing. Users no longer needed to bank separately to access loan products, as financing options were available directly within the platform.

The result was a lending product that sold itself, in flow, in context, and with impact.

Final Takeaways: Growth Through Product Design

Modern fintech products aren’t just about usability. They’re about guidance, personalization, and intelligence.

Embedded finance refers to the integration of financial services into non-financial platforms, transforming how users access financial products.

Companies can embed financial services such as payments, lending, and wealth management directly into their platforms to enhance financial access and customer engagement. Embedded fintech and strategic partners are driving innovation by collaborating with financial institutions to deliver seamless financial experiences.

Financial literacy is crucial in empowering users to make informed decisions within embedded financial ecosystems. Embedded solutions are expanding access to wealth management and cross border transactions, making sophisticated financial services more accessible to a broader audience.

Key principles to embed in your strategy include:

- Stream Insights to the UI: Your product should act on data, not just report it.

- Design Adaptively: Rigid flows break. Modular, state-aware designs engage.

- Measure Revenue Impact: Use PQLs and CLV to link UX changes to business results.

If done well, your product becomes your top-performing growth engine. It converts in the moment, delights with relevance, and builds loyalty through utility.

You’re not just offering financial services; you’re delivering smarter outcomes. And people will always pay for better outcomes.

Frequently Asked Questions (FAQs)

What is embedded intelligence in financial products?

Embedded intelligence refers to the integration of real-time data analysis, machine learning models, and adaptive interfaces within financial products to deliver personalized user experiences and enable context-aware interactions that drive engagement and revenue.

How can embedded intelligence drive revenue for banks?

By proactively analyzing user behavior and surfacing relevant offers at the right time, embedded intelligence converts user interactions into monetization opportunities, such as upsells, cross-sells, and increased product adoption.

What are examples of embedded intelligence in financial services?

Examples of embedded intelligence in financial services include:

- Prompting users with high balances to open a savings account.

- Suggesting low-interest loan options when detecting financial stress.

- Reordering app dashboards based on user priorities.

How do Product-Qualified Leads (PQLs) and Customer Lifetime Value (CLV) relate to embedded intelligence?

PQLs and CLV are key metrics for tracking how effectively embedded intelligence drives user readiness for upgrades, product stickiness, and overall customer profitability.