Jump To Section

- 1 The Strategic Imperative of Design in Financial Services

- 2 Understanding Design Maturity in Financial Services

- 3 The 4-Phase Strategic Playbook for Human-Centered Design

- 4 The Role of AI in Shaping Next-Generation Financial Experiences

- 5 Upskilling Design Teams for the AI Era

- 6 Global Success Stories: Design Thinking in Action

- 7 Future Trends Shaping Financial Services Design

- 8 Final Takeaways: Key Lessons for Financial Services Leaders

- 9 FAQs

In an industry where customer expectations are higher than ever and digital disruption is relentless, financial institutions face a critical challenge: how to design experiences that not only meet but exceed client demands.

According to Altimeter’s State of Digital Transformation report, two thirds of financial services organizations identify delivering a consistent customer experience across all touchpoints as their top priority.

This statistic highlights a pressing reality:

Without innovative, human-centered design, financial firms risk falling behind in a fiercely competitive market.

This article dives deep into the transformative power of financial services design, revealing how strategic design thinking, cutting-edge technology, and a focus on user experience can drive growth, build trust, and future-proof your business while doubling your ROI.

The Strategic Imperative of Design in Financial Services

Financial services, encompassing banking, insurance, and wealth management, face increasing pressures to deliver intuitive, seamless, and personalized experiences.

Companies in the financial services industry are rethinking their approach to design to stay competitive.

Customers expect instant access, transparency, and trustworthiness. Amidst heightened competition from fintech disruptors, traditional banks and institutions must rethink their approach to design, embedding it deeply into their organizational fabric.

Research consistently shows that effective design in financial services leads to improved customer satisfaction and business outcomes, further supporting the importance of design in financial services, highlighting its role in driving innovation and customer loyalty.

Design thinking provides a framework to navigate this complexity. It enables leaders to understand customer pain points, innovate rapidly, and develop products and services that are not only functional but also meaningful.

Understanding Design Maturity in Financial Services

Design maturity measures how effectively an organization integrates design principles into its operations, culture, and decision-making processes.

In financial services, high design maturity correlates with improved customer loyalty, increased operational efficiency, and accelerated innovation.

The thoughtful implementation of design principles is a key differentiator for financial services firms, enabling them to adapt quickly and deliver superior workplace and digital experiences.

Organizations at advanced levels of design maturity:

- Embed customer insights into every decision, ensuring products resonate deeply with end users.

- Break down silos, enabling cross-functional collaboration between design, technology, and business units.

- Drive the development of cross-functional capabilities, supporting agile processes and continuous improvement.

- Measure success through a blend of financial and experiential metrics.

Consider this: Financial institutions that invest in design outperform their peers by nearly 2X in revenue growth and shareholder returns, according to the McKinsey Design Index, 2024. Notable projects within leading financial services firms demonstrate how design maturity translates into tangible business impact, from innovative workplace transformations to successful digital product launches.

For financial services firms, achieving design maturity isn’t just a competitive advantage; it’s a strategic necessity in a rapidly evolving marketplace.

The 4-Phase Strategic Playbook for Human-Centered Design

Human-Centered Design (HCD) offers a practical, outcome-driven playbook to elevate customer trust and business performance. HCD goes beyond aesthetics, it equips organizations to create intuitive, human-centric solutions that deliver measurable ROI while navigating complex regulatory and technological environments.

At its core, HCD is an iterative process that blends creativity with structured problem-solving, ensuring user needs remain central throughout.

Financial services executives and planners can use this playbook to align product, operations, and technology teams under a shared vision of client-centricity.

The Four Phases of the Human-Centered Design Playbook

Phase 1: Understand

Leaders must invest time in deeply researching and empathizing with end users. This phase involves mapping out client journeys, identifying friction points, and uncovering behavioral patterns that impact financial decision-making.

For financial services, this often includes:

- Unpacking anxiety drivers around complex products like mortgages or investments.

- Understanding regulatory and compliance requirements that influence user flows.

- Surfacing unmet needs across digital and in-branch touchpoints.

Phase 2: Ideate

Mobilize cross-functional teams, including design, technology, and compliance, to brainstorm a wide range of creative solutions. Mid-market executives should focus on ideas that:

- Simplify decision-making for clients.

- Build transparency into product and service offerings.

- Leverage AI and automation to anticipate customer needs.

Phase 3: Prototype

Develop rapid, low-fidelity models of the most promising solutions. These prototypes allow leaders to test hypotheses with minimal investment and adjust based on early feedback. This phase includes:

- Testing new onboarding flows with select customer segments.

- Trialing conversational AI assistants for customer service.

Phase 4: Test

Deploy prototypes in real-world settings, gathering qualitative and quantitative insights. This phase ensures your solutions are refined and market-ready before scaling. Importantly, testing also helps address potential compliance risks and user adoption challenges early.

- Pilot Across Multiple Channels: Validate how solutions perform across mobile, web, and in-branch environments to ensure consistency and scalability.

- Measure Business Impact: Track KPIs such as cost-to-serve, customer satisfaction (CSAT), and revenue lift to demonstrate ROI to stakeholders.

- Iterate Quickly: Leverage agile methodologies to incorporate real-time feedback from customers and frontline staff.

Financial services firms that embrace human-centered design consistently outperform peers by achieving:

- Stronger client relationships: By demystifying complex products.

- Operational efficiency: Streamlined processes reduce cost-to-serve.

- Accelerated innovation cycles: Prototyping and testing reduce time-to-market.

By integrating this framework into strategic planning, executives can ensure every initiative, from mobile apps to branch redesigns, is purpose-built to drive growth and future-proof the business.

The Role of AI in Shaping Next-Generation Financial Experiences

Artificial Intelligence (AI) and machine learning are transforming the landscape of financial services.

For design leaders, this evolution presents a dual challenge: leveraging AI’s predictive capabilities while ensuring human-centered principles remain at the core.

The latest technology, such as AR and VR, is also influencing the design of financial services experiences, shaping how users interact with digital platforms and envisioning the future of user experience.

AI can:

- Personalize Experiences: Tailor interactions to individual preferences, financial behaviors, and life stages.

- Predict Needs: Anticipate customer requirements and proactively offer solutions.

- Automate Complexity: Streamline processes like loan approvals and fraud detection.

Selecting the right tools and adopting new tools, such as open API stores and microservices, is crucial to support AI-driven design and enable agility in digital transformation.

However, without thoughtful design, AI risks alienating customers. Trust, transparency, and ethical considerations must be embedded into AI-driven experiences.

Key principles for designing AI-enhanced experiences include:

- Transparency: Clearly communicate how AI makes decisions.

- User Control: Allow customers to review, override, or opt out of automated suggestions.

- Feedback Loops: Continuously refine the system based on end user input to ensure responsiveness to their needs.

By balancing automation with empathy, design leaders can create experiences that are not only efficient but also deeply human.

To learn how you can leverage AI to boost growth with your financial products, read our detailed guide here: 3 Embedded-Intelligence Plays to Transform Financial Products into Growth Engines.

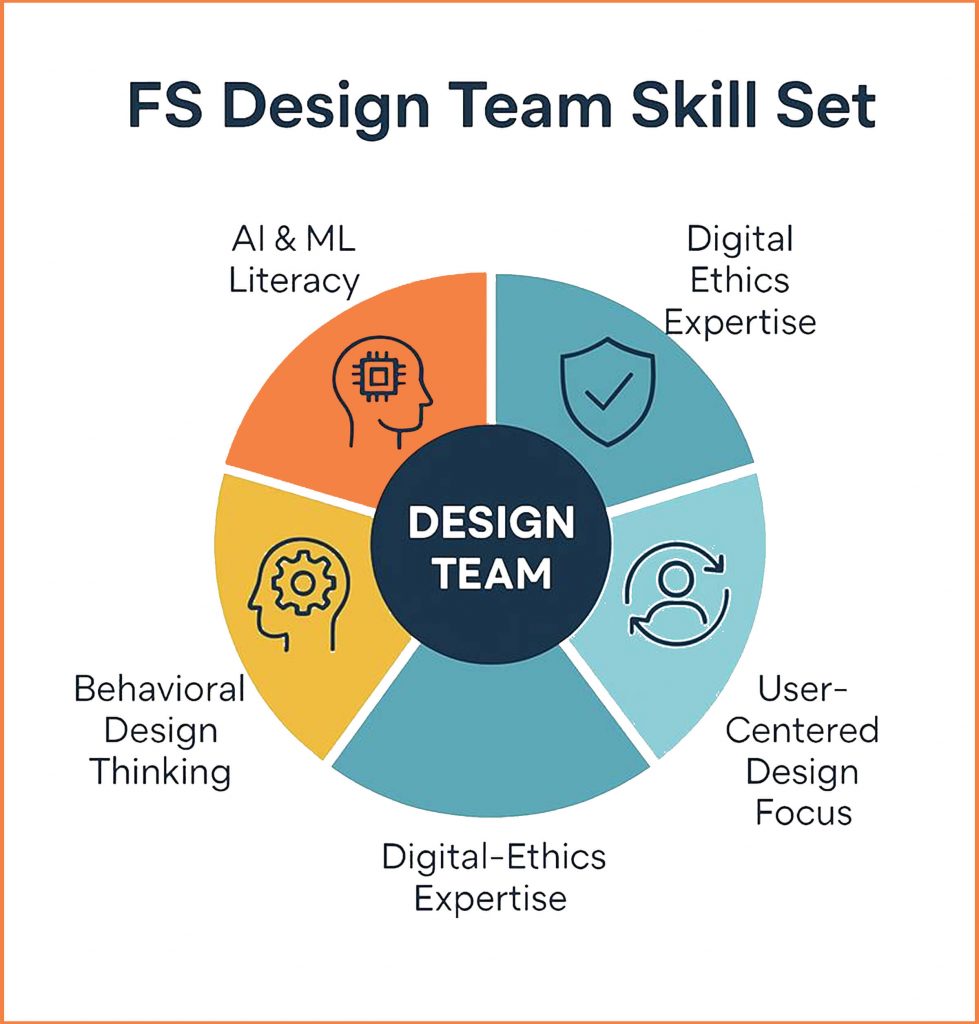

Upskilling Design Teams for the AI Era

As AI reshapes how financial products are designed and delivered, design teams must evolve to meet the complexity of next-generation experiences.

Financial services leaders should prioritize building multidisciplinary teams that are equipped to thrive at the intersection of design, data science, and ethical innovation.

Why Upskilling Is Critical

As we move forward, FS leaders can no longer presume upskilling design teams to be optional. To stay ahead in the race to innovate, it is critical to understand the true impact of upskilling:

- Emerging technologies like generative AI, predictive analytics, and adaptive UIs are rapidly becoming standard tools in financial services. Teams unable to integrate these technologies into their workflows will fall behind.

- Regulatory environments are evolving alongside technology. Designers must understand compliance requirements to create solutions that are both innovative and secure.

- Clients expect seamless omnichannel experiences, meaning designers must now think beyond screens to voice interfaces, wearables, and immersive environments.

Key Areas for Upskilling the Design Team Skillset

The following areas highlight where design teams in financial services can strengthen capabilities to stay competitive in upcoming times:

Technical Literacy

Beyond understanding the basics of AI, designers must grasp how algorithms work, their limitations, and how to collaborate with engineering teams to shape user experiences that are both technically feasible and user-friendly.

Practical steps include attending AI/ML workshops, shadowing data scientists, and learning how APIs integrate into financial platforms.

Behavioral Design

Teams need to study customer behavior in depth, using tools like eye-tracking, journey mapping, and cognitive load analysis.

Applying behavioral economics principles helps craft user flows that minimize decision fatigue and maximize engagement.

Running small-scale experiments (A/B tests) provides actionable insights into user preferences and pain points.

Ethical Frameworks

As AI makes decisions in sensitive financial contexts, teams must be equipped to identify and mitigate bias in algorithms, ensure accessibility for diverse user groups, and design with transparency in mind.

Establishing an internal ethics review board and developing checklists for bias and privacy audits are practical measures.

Data-Driven Design

Designers should learn to translate analytics into actionable insights,understanding KPIs like churn rate, conversion metrics, and NPS.

Building dashboards in collaboration with analysts enables design teams to iterate quickly and back decisions with solid data.

Encourage designers to complete certifications in data visualization tools like Tableau or Power BI.

Collaboration Across Functions

Success requires designers to align with product managers, compliance officers, and technologists.

Leaders should set up cross-functional working groups and regular “design huddles” to break silos and keep customer outcomes front and center.

How to Build Future-Ready Teams

- Launch AI + Design bootcamps for internal talent.

- Engage in cross-functional design sprints with stakeholders from IT, compliance, and customer service.

- Partner with universities or certification programs offering advanced HCD and AI curricula.

- Encourage design leaders to participate in global financial UX/AI forums to stay ahead of trends.

Investing in upskilling now positions financial services firms to deliver cutting-edge, human-centered innovations that resonate with tomorrow’s customers.

Global Success Stories: Design Thinking in Action

Financial services design has proven its transformative power across the globe, with numerous institutions leveraging design thinking to solve complex challenges, enhance client experiences, and streamline operations.

Below are examples that showcase how leading financial firms have applied innovative design principles to drive measurable success and create meaningful impact.

Simplified Saving: Bank of America’s “Keep the Change”

By rounding up purchases and transferring the difference into savings, this initiative made saving money effortless and engaging, leading to a surge in new account openings.

Accelerated Loan Processing: NAB’s QuickBiz Loan

The National Australian Bank reduced loan application times from weeks to minutes by applying design thinking and streamlining user flows. The QuickBiz Loan was specifically designed to serve the needs of small business clients, making the application process faster and more efficient.

SME Financial Management Tool: Deutsche Bank’s SME Financial Tool

A digital tool created through design sprints helped small businesses manage finances efficiently, driving both customer loyalty and operational excellence.

Future Trends Shaping Financial Services Design

Looking ahead, financial institutions must prepare for a significant shift in the design and function of their spaces and workplace environments, reflecting shifting trends in the financial services industry. This shift is driving the creation of world-class, purpose-built spaces that enhance collaboration, transparency, and company culture.

- Hyper-Personalization: Leveraging real-time data to deliver unique experiences.

- Conversational Interfaces: Using natural language processing to simplify interactions.

- Omnichannel Journeys: Ensuring consistency across web, mobile, and in-branch touchpoints by creating integrated experiences that unify digital and physical interactions.

- Proactive Financial Health Management: Anticipating customer needs and offering timely advice.

Future workplace design and spaces will enhance employee experience and support business goals by fostering environments that attract talent, encourage teamwork, and reflect organizational values.

Design leaders who embrace these trends and shift toward integrated, world-class workplace solutions will position their organizations at the forefront of innovation.

Final Takeaways: Key Lessons for Financial Services Leaders

As financial services firms navigate an increasingly complex and competitive landscape, design emerges as a critical strategic lever, not merely a cosmetic addition.

Executives must recognize that design is a powerful business driver that shapes future business models, fuels sustainable growth, and differentiates brands in crowded markets.

I discuss in detail how financial institutions can create better banking experiences that go beyond vanity metrics and generate true business impact in this article: Beyond the Interface: Designing Better Digital Banking Experiences

Design is a catalyst for innovation and resilience

Embedding design thinking across the organization unlocks new ways to solve customer challenges, streamline operations, and accelerate product development. This approach fosters a culture of continuous improvement and creative problem-solving that is essential in today’s fast-evolving financial ecosystem.

AI-enhanced design delivers hyper-personalized, trust-building experiences

By leveraging artificial intelligence thoughtfully and ethically, financial firms can anticipate client needs, automate routine tasks, and provide seamless, intuitive interactions. However, success depends on balancing automation with transparency and user control to maintain customer trust and regulatory compliance.

Design maturity is a competitive advantage

Firms with advanced design maturity outperform peers in customer loyalty, operational efficiency, and revenue growth. Achieving this maturity requires cross-functional collaboration, data-driven insights, and a relentless focus on the end user’s evolving expectations.

Upskilling design and technology teams is essential for long-term success

Developing multidisciplinary capabilities, including technical literacy, behavioral design, and ethical frameworks, empowers teams to harness emerging technologies and deliver superior client experiences. Investing in continuous learning and cross-disciplinary collaboration prepares organizations to adapt to future disruptions.

Expert guidance accelerates transformation and mitigates risk

Partnering with design specialists and consultants provides critical insights, best practices, and proven methodologies that enable financial services firms to make informed investment decisions and evolve business models effectively.

In sum, financial services executives who prioritize design as a strategic imperative position their organizations to lead in innovation, build lasting client relationships, and thrive in an increasingly digital and customer-centric world.

FAQs

Q1: What is design maturity in financial services?

A: Design maturity refers to how deeply design principles are embedded in an organization’s strategy and culture, impacting customer experience and business outcomes. In the context of financial services firms, design serves the specialized role of creating user-centric, secure, and efficient digital financial services, distinguishing itself from general service design by addressing the unique needs and regulatory requirements of the financial industry.

Q2: How can banks use design thinking to drive innovation?

A: By applying empathy, ideation, prototyping, and testing to solve customer challenges and rapidly iterate on solutions. For example, Capital One’s investment in office and workplace design demonstrates how capital can be strategically allocated to foster innovation and collaboration.

Q3: What are examples of AI-enhanced customer experiences?

A: AI-powered chatbots, predictive financial advice, and automated fraud detection systems. Capital One’s use of AI in their customer service platforms is a leading example of how financial firms leverage technology to enhance user experience.

Q4: How can financial institutions improve customer trust through design?

A: By ensuring transparency, user control, and ethical use of data in all digital touchpoints. The company’s brand and commitment to quality are reflected in office design choices that communicate trustworthiness and professionalism to clients and employees alike.

Q5: Why is human-centered design critical for financial services?

A: It ensures products meet real customer needs, enhancing loyalty and long-term engagement. For financial firms serving high net worth individuals, it is essential to design spaces that reflect the company’s brand and quality, while providing enclosed spaces for privacy and collaboration. This approach supports both the operational needs of the firm and the expectations of discerning clients.