Jump To Section

- 1 The Strategic Shift: Viewing User Experience in Banking as Infrastructure, Not Just Interface

- 2 The Business and Compliance Risks of Poor UX Design

- 3 Designing for Secure Simplicity

- 4 Connecting Fragmented Systems through UX

- 5 UX for Regulatory Alignment

- 6 Designing for Scalability and Reuse

- 7 Designing for Accessibility: How Inclusive UX Design Reduces Risks

- 8 How UX Design Becomes the Infrastructure of Customer Trust

- 9 Best Practices for UX-Driven Digital Banking

- 10 UX and the Emerging Future of Digital Banking

- 11 Final Thought: Strategic Takeaways for Banking Leaders

Imagine this: A customer opens your mobile banking app to apply for a credit card. Three taps in, they’re asked to re-enter their SIN, confirm their phone number, and read through a dense wall of legalese. Ten seconds later, they’ve dropped off—frustrated, confused, and gone.

Multiply that moment by thousands of users a day, and the cost is staggering.

But even as digital adoption accelerates, many banking platforms remain tied to outdated design models—built for compliance, not customers.

The result? Rising drop-off rates. Ballooning call centre volumes. Mounting pressure from regulators. And a growing trust gap.

Today’s digital banking isn’t just about sleek interfaces—it’s about building the invisible infrastructure of trust, security, and scale.

This article explores how banks can reduce risk, improve compliance, and unify fragmented systems by rethinking UX as a foundational layer, not just a frontend detail.

Drawing on real challenges in financial services, you’ll learn why UX-led infrastructure is essential to meeting modern customer expectations while supporting operational resilience, and how to create consistent, compliant, and human-centred experiences that go far beyond the interface.

The Strategic Shift: Viewing User Experience in Banking as Infrastructure, Not Just Interface

The digital banking landscape has undergone dramatic change over the past decade, with a clear shift toward mobile-first design. Mobile banking has surged, with users increasing from 53% in 2019 to 61% in late 2024 (according to Statista’s Consumer Insights). It is now the most common way people do their banking.

At the same time, conversational banking is on the rise. Chatbots and voice assistants are being integrated into banking platforms to manage basic requests, offer financial advice, and guide users through complex transactions. While still maturing, conversational AI technologies show promise in reducing friction and enhancing accessibility—especially for users who prefer natural language interactions over tapping and scrolling. Learn some top strategies on building smart customer interactions with conversational AI here.

As more interactive features are added, banks need to make sure everything works seamlessly. Whether customers use mobile banking apps, websites, or talk to staff, they want a consistent experience and feel confident that their accounts are secure. These two priorities – cohesive integration and security – often need to be carefully balanced. This requires both good design and strong backend systems working together, balancing security and usability.

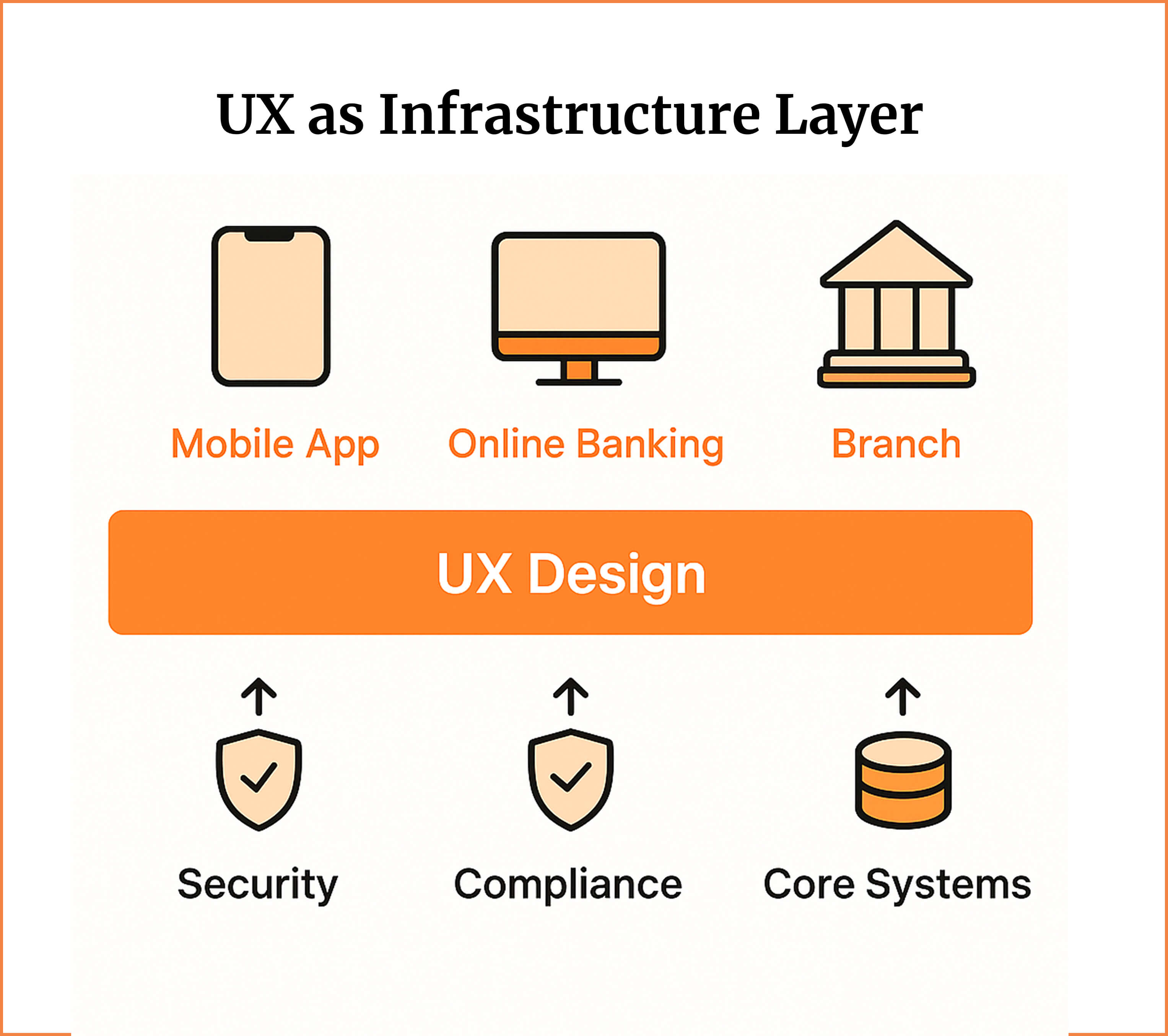

So, in the past, where UX was often viewed as “finishing polish”—something applied at the end of a banking project to make it look better, today, it has become the foundational layer where:

- Backend systems meet customer-facing tools

- Security measures meet usability

- Compliance frameworks meet human behaviour

In essence, UX has become infrastructure. And in digital banking, that infrastructure determines whether customers stay, transact, and trust—or leave, drop off, and escalate to service centres.

Especially when UX is misaligned with user expectations or regulatory requirements, the consequences aren’t superficial—they’re systemic and costly.

The Business and Compliance Risks of Poor UX Design

Banking leaders understand risk in terms of compliance, cybersecurity, and operational resilience. But what’s often overlooked is how poor UX design introduces silent, compounding risks such as:

Customer frustration and abandonment

When users encounter confusing, slow, or overly complex digital experiences, they become frustrated and may abandon their tasks altogether. Overwhelming users during the onboarding process with complicated or lengthy registration can lead to user abandonment. This leads to lost revenue opportunities and higher customer churn rates, directly affecting the bank’s bottom line.

Failure to meet accessibility standards

Inadequate attention to accessibility can expose banks to legal liabilities and public scrutiny. Non-compliance with standards such as the Accessibility for Ontarians with Disabilities Act (AODA) or the Americans with Disabilities Act (ADA) not only risks lawsuits but also alienates a significant portion of potential users who rely on assistive technologies.

Inconsistent flows across channels

Fragmented user experiences across mobile apps, websites, call centres, and branches can cause confusion. Checking account balances is a fundamental task that should be seamless and efficient across all digital banking platforms. Customers expect seamless digital interactions regardless of the platform, and inconsistencies can damage the bank’s reputation and increase operational costs due to duplicated support efforts.

Security procedures that alienate users

While security is paramount, overly complicated or poorly designed security steps can frustrate users, leading to decreased adoption of digital services and an increased support load. Striking the right balance between robust security and user-friendly design is essential to maintaining both safety and customer satisfaction.

By proactively addressing these UX-related risks and balancing security with usability, financial institutions can not only improve customer satisfaction and loyalty but also reduce legal exposure, operational inefficiencies, and reputational damage.

Good UX doesn’t eliminate all friction—but it manages it purposefully. When designed right, even security prompts or compliance disclosures become usable, understandable, and efficient.

Designing for Secure Simplicity

Security remains a top concern in digital banking—and rightly so. But too often, measures intended to protect users end up alienating them. Multi-factor authentication, for example, adds an essential layer of defense, but can introduce unnecessary complexity if poorly implemented.

When designing banking apps, it is crucial to balance usability, functionality, and security to enhance customer loyalty and engagement.

Every security checkpoint should serve both protection and user clarity.

The key is to adopt security measures that are minimally disruptive, like:

Biometric authentication (face ID, fingerprints) for seamless access

Biometric authentication, specifically fingerprint and facial recognition, have emerged as the trusted security measures in banking according to a recent study by US-based company, Aware. Biometric technologies enhance security and provide seamless access to account information, addressing user concerns about data breaches and security threats. This shift from traditional methods provides both security and convenience.

Context-aware MFA, triggered only during high-risk transactions

Similarly, AI-driven fraud detection systems can work silently in the background to identify suspicious behavior without requiring active user intervention.

Progressive disclosure, introducing information gradually to avoid overload

Connecting Fragmented Systems through UX

Most enterprise banks operate across siloed platforms—web apps, mobile apps, contact centres, and branch systems. These often run on different backend infrastructure, which makes consistent UX a major challenge.

Here’s where UX becomes the connective tissue.

A strong UX design system:

- Unifies user journeys across products and platforms

- Aligns design language and interaction patterns

- Hides backend complexity behind coherent interfaces

Considering various aspects, including user scenarios and workflows, helps craft an ideal user journey map that aligns with customer needs and technological opportunities.

For example, enabling customers to start a mortgage application on mobile, get support through a chatbot, and complete in-branch—without repeating information—requires seamless orchestration at both design and technical levels.

UX for Regulatory Alignment

Regulatory compliance in banking—around disclosures, consent, accessibility, and privacy—is complex and ever-evolving. UX plays a pivotal role in surfacing the right information at the right moment, in the right way.

Aligning IT strategy with overall business strategy is crucial in this rapidly changing business landscape, ensuring that strategic decisions are informed by data-driven insights.

Effective UX supports compliance by:

- Displaying mandatory information contextually (e.g., privacy terms before consent)

- Offering accessible interfaces that meet AODA and ADA standards

- Creating audit-friendly user flows (clear logs, versioning, retraceable paths)

A risk-aware UX team collaborates closely with legal, risk, and cybersecurity leaders. They build journeys that don’t just check boxes—they genuinely help users understand their rights and responsibilities.

Designing for Scalability and Reuse

Banks don’t build one experience. They build hundreds: product sign-ups, service requests, dashboards, notifications, etc.

Identifying and showcasing key features within these experiences, especially during the onboarding process, can significantly enhance user satisfaction and loyalty.

Without a reusable UX design system:

- Teams duplicate effort

- Quality is inconsistent

- Releases take longer

But with scalable UX infrastructure, design becomes a multiplier:

- Teams reuse approved components with built-in accessibility and security logic

- Updates roll out faster and more consistently

- Business and compliance teams gain confidence in the experience layer

This is why many banks are now investing in cross-functional design systems, with shared libraries, standards, and governance.

UX isn’t just about customer outcomes—it’s a strategic enabler of delivery velocity and governance control.

Designing for Accessibility: How Inclusive UX Design Reduces Risks

Designing for accessibility is a requirement, period. Inaccessible banking interfaces increase:

- Legal risk (non-compliance with AODA/ADA)

- Service load (users needing call centre help)

- User attrition (especially among seniors or those with impairments)

Inclusive design also enhances users’ financial knowledge by providing easily accessible educational resources, such as videos and interactive tutorials.

Inclusive design practices include:

- Supporting screen readers and keyboard navigation

- Providing alternative text, clear contrast, and readable font sizes

- Avoiding jargon and writing in plain language

A well-designed inclusive customer experience reduces cost, increases satisfaction, and protects your institution from reputational or legal risk.

How UX Design Becomes the Infrastructure of Customer Trust

Trust is not a feature you add—it’s something you build, brick by brick, with consistent, seamless, and respectful experiences.

UX becomes the most visible layer of your infrastructure. It shapes how people perceive your bank’s reliability. When customers feel guided, protected, and in control, they’re more likely to return, refer others, and deepen their relationship with your services. But trust is fragile—when it’s broken by inconsistent interfaces, unexpected friction, or poorly explained policies, recovery is slow and costly.

To build trust through UX, banks must focus on four key experience pillars:

- Clarity to ensure users always understand what’s happening and what’s expected.

- Consistency to reduce cognitive load across different channels and products.

- Control gives customers confidence that their actions are intentional and reversible

- Care makes interactions feel human, supportive, and respectful.

This approach to UX isn’t about simply smoothing over pain points. It’s about proactively earning customer confidence through thoughtful design choices. That’s why UX can’t be the last thing added to a project—it must be baked into the infrastructure that supports every touchpoint.

In an increasingly digital world, where face-to-face reassurance is rare, UX becomes the handshake, the eye contact, the follow-through. It’s how institutions build—or lose—trust.

That’s why banks must stop thinking of UX as an embellishment and start treating it as the infrastructure of digital trust. To learn more on employing AI while maintaining the human element, read this article on AI ethics and challenges.

Best Practices for UX-Driven Digital Banking

Using AI to Personalize and Scale UX in Banking

Artificial intelligence (AI) is revolutionizing financial planning by providing personalized insights and recommendations based on user data. AI-driven tools can analyze spending patterns, predict future expenses, and offer tailored financial advice, empowering users to make informed decisions about their finances.

One of the key benefits of AI in financial planning is its ability to provide real-time, data-driven insights. By analyzing transaction history and account balances, AI algorithms can identify trends and suggest ways to optimize spending and saving. For example, an AI-powered budgeting tool can alert users when they are approaching their monthly spending limit or recommend adjustments to their financial goals.

However, the use of AI in financial planning also raises important considerations around transparency and user trust. Financial institutions must ensure that their AI algorithms are transparent and that users understand how their data is being used. Establishing clear data policies and obtaining user consent are essential to building trust and maintaining compliance with regulatory standards.

AI can also enable banks to tailor personalized experiences based on user behavior, financial history, and goals. Dashboards, smart budgeting tools, and targeted product recommendations make users feel understood and more likely to engage.

Digital technology plays a crucial role in enhancing these personalized experiences, making financial management more accessible for all age groups. Trust in personalized banking services stems from empowerment rather than intrusion. This involves creating transparent data policies, establishing consent-based personalization frameworks, and regularly auditing privacy measures to ensure they align with customer expectations and regulatory requirements.

Omni-channel consistency

True omnichannel banking means customers can start a task on one channel and finish it on another—without disruption. Whether initiating a loan application online and completing it in-branch or receiving personalized financial advice via a chatbot that’s informed by prior mobile activity, the experience must feel unified.

A seamless navigation of a mobile banking app significantly influences customer interactions and satisfaction, making it a critical component of the overall user experience. It is crucial to have synchronization across touchpoints, shared data infrastructure, and cohesive design systems. It’s not just about the same look and feel —it’s about functioning as one continuous service.

How Design Thinking Enhances UX in Banking

Design thinking is a human-centred approach to problem-solving that has gained traction in various industries, including banking. At its core, design thinking emphasizes empathy, user research, and iterative design to create solutions that meet the needs of users. In the context of banking, this means understanding the pain points and preferences of customers and designing digital products that address these needs effectively.

Empathy is the cornerstone of design thinking. By putting themselves in the shoes of their customers, UX designers can gain valuable insights into the challenges and frustrations that users face when interacting with banking services. This understanding informs the design process, ensuring that the final product is intuitive and user-friendly.

User research is another critical component of design thinking. Through surveys, interviews, and usability testing, designers can gather feedback from real users and identify areas for improvement. This iterative process allows for continuous refinement of the user interface, resulting in a more polished and effective product.

In the banking sector, design thinking can lead to innovative features that enhance the customer experience. For example, integrating biometric authentication methods like fingerprint scanning and facial recognition can streamline the login process while maintaining security. Similarly, designing mobile banking apps with clear navigation and accessible interfaces can improve user satisfaction and foster customer loyalty.

UX and the Emerging Future of Digital Banking

The future of banking is being shaped by emerging technologies that promise to enhance the user experience and improve operational efficiency. Machine learning, biometric authentication, and blockchain are just a few of the innovations that are poised to transform the banking sector.

Machine learning algorithms can analyze vast amounts of data to detect fraud, predict customer behavior, and optimize financial products. By leveraging big data, banks can gain deeper insights into customer preferences and tailor their services accordingly. This not only improves customer satisfaction but also helps financial institutions stay competitive in a rapidly evolving market.

Biometric authentication methods, such as fingerprint scanning and facial recognition, are becoming increasingly popular for securing digital banking platforms. These technologies offer a seamless and secure way for users to access their accounts, reducing the risk of unauthorized access and enhancing the overall user experience.

Blockchain technology has the potential to revolutionize financial transactions by providing a secure and transparent ledger for recording transactions. This can streamline processes, reduce costs, and increase trust in the banking system. As blockchain technology continues to evolve, it is likely to play a significant role in the future of digital banking.

To remain competitive, financial institutions must embrace these emerging technologies and continuously innovate their digital products. By prioritizing UX design and staying ahead of UX trends, banks can deliver exceptional experiences that meet the evolving needs of their customers.

The current and future impact of AI in banking is a vast discussion. For an in-depth conversation and profound insights into how the future of banking is being shaped b AI, be sure to read this article: The Potential Impact of AI on the Future of Banking.

Final Thought: Strategic Takeaways for Banking Leaders

In the digital age, user experience is not just an interface—it’s the infrastructure that underpins the entire banking ecosystem.

By treating UX as a strategic priority, financial institutions can create seamless, secure, and user-centric digital experiences that foster customer loyalty and trust.

Banking leaders must recognize the importance of UX in driving digital transformation and take proactive steps to address UX-related risks, asking critical questions like

- Are we treating UX as a frontend feature or strategic infrastructure?

- Where might poor UX be introducing compliance, security, or customer risks?

- Do our journeys support cross-channel continuity and auditability?

- Is accessibility baked into our design processes—or retrofitted later?

Additionally, consider how user feedback can be leveraged to make iterative improvements and adapt to evolving user needs.

Recommended actions

- Conduct a UX risk audit across top user journeys

- Establish a design system aligned with compliance and security

- Make UX a shared responsibility across risk, IT, product, and service

The future of digital banking depends on experience—specifically, the ability to deliver experiences that are secure and user-centric. This means rethinking legacy systems, embracing emerging technologies, and designing with empathy.

Through purposeful UX design, using AI to personalize without overstepping, and ensuring consistency across every interaction, banks can not only meet but exceed the rising expectations of their customers.

The challenge is significant—but so is the opportunity to lead in digital finance.